7 Horrible Financial Bombshells For Divorcing Women

Texting and Emails May Affect Your Divorce

July 2, 2018

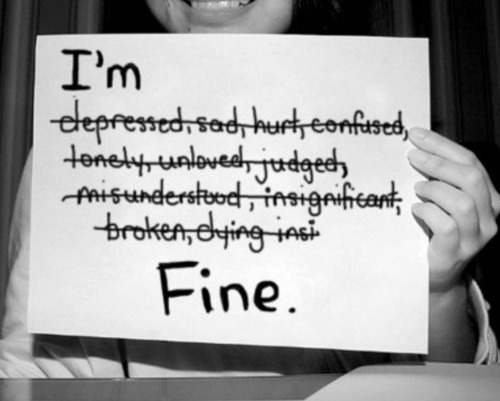

Avoiding Post-Divorce Depression

August 20, 20187 Horrible Financial Bombshells For Divorcing Women

An amazing 46% of divorced women recently surveyed by the online marketplace Worthy said that divorce brought with it financial surprises. I’m a Family Law Attorney, and I can report that the women I work with who are getting divorced often ask me about their financial future resulting from divorce.

In the Worthy study, Building a Financial Fresh Start, 1,785 adult women were surveyed across three stages: those with divorce “on the horizon,” those in the midst of divorce and those who described themselves as “divorced and determined.” Some 22% of the women were 55 or older; most of those were already divorced.

In my over 40 years of practicing family law I’ve found that there are seven financial bombshells divorcing or divorced women often run into during their divorce are:

- The staggering cost of health care insurance – Once you are a single person, you are no longer eligible to be covered under your spouse’s health insurance. This is something that should be discussed when considering a divorce or during the divorce process

- Assuming child support and/or alimony would be higher or last longer – The amount of child support is set by law, and there is a definite termination date for child support. The amount and duration of spousal support is more difficult to determine. Again, this is a subject that needs to be fully vetted so that you will have a general idea what to expect

- Not anticipating they would have to return to the workforce – In long term marriages where the wife has stayed home to care for the kids and the home, the thought of going to work can be daunting. However, becoming employed can give a sense of independence and will take one’s mind off of the divorce.

- Assuming they could keep the marital home – It is possible to keep the marital home if you have the financial ability to buy your husband’s interest in it. Before making this decision, you should examine your own finances to see if it is economically feasible to do so. The question is really whether it is financially practical to keep the home.

- Underestimating the cost of getting a divorce – This issue should clearly be discussed with your attorney at the beginning of your case. While he/she will not be able to say with certainty what the cost will be, a discussion should be had what the potential costs will be from beginning to end.

- Being unaware of the total size of their marital debt including the primary mortgage, home equity line of credit, auto financing, credit card debt, 401(k) loans and student loans – It is best to have this information before speaking with an attorney. If it is not possible to obtain this information because of the husband’s absolute control of everything financial, this information has to be disclosed during the divorce process.

- The cost of child care (babysitters) – This is important when the wife is working or is expected to become employed. Inquiry should be made regarding the reasonable cost of child care. Remember that the husband will be required to share equally the amount of child care needed for the wife to be employed or to gain education/training to become employable.